Investing in Water: Exploring Opportunities for Sustainable Profits

In today’s rapidly changing world, investing sustainably has become more important than ever before. As we grapple with the impact of climate change, one resource in particular has emerged as a critical investment opportunity: water. With growing population demands, increasing industrialization, and the ever-present threat of water scarcity, investing in water is not only a smart move financially, but also an opportunity to make a positive impact on our planet.

The Growing Importance of Water Investments

Water is the essence of life. Without it, no living organism can survive. As the world’s population continues to rise, the demand for water is increasing at an alarming rate. The strain on our freshwater resources is becoming more apparent, creating a need for innovative solutions and investment opportunities.

Investing in water is a way to not only secure financial returns but also support sustainable development. By investing in water-related businesses and technologies, we can contribute to the preservation and conservation of this precious resource while generating profits.

One area of water investment that is gaining traction is water infrastructure projects. These projects involve the construction and maintenance of water-related facilities such as dams, pipelines, and treatment plants. Investing in water infrastructure is crucial for ensuring access to clean water for communities around the world. It also plays a key role in managing water resources effectively and efficiently.

Another promising avenue for water investments is in water technology companies. These companies focus on developing innovative solutions to address water scarcity, pollution, and wastewater treatment. By investing in these companies, individuals and organizations can support cutting-edge research and development efforts that have the potential to revolutionize the way we manage and conserve water resources.

Understanding the Global Water Crisis

The global water crisis is a multifaceted issue that transcends geographical boundaries and impacts various aspects of human life. It is estimated that over 2 billion people worldwide lack access to clean and safe drinking water, leading to a myriad of health problems and hindering socio-economic development in many regions. The scarcity of water resources is further exacerbated by climate change, population growth, and inadequate infrastructure, creating a complex web of challenges that require urgent attention and innovative solutions.

Furthermore, the global water crisis not only affects human populations but also has profound implications for ecosystems and biodiversity. Aquatic habitats are under increasing pressure due to water pollution, over-extraction of water resources, and habitat destruction, leading to the decline of numerous species and disruption of fragile ecosystems. Addressing the water crisis is not only a matter of human survival but also a crucial step towards preserving the planet’s natural heritage and ensuring the sustainability of life on Earth.

By investing in water, we can support a wide range of initiatives that seek to address the root causes of water scarcity and pollution, promote water conservation and efficiency, and foster community resilience to water-related challenges. These investments play a vital role in advancing sustainable development goals, promoting social equity, and safeguarding the environment for future generations. It is imperative that stakeholders across sectors collaborate and prioritize water management strategies to secure a water-secure future for all.

Trends and Innovations in Water Technology

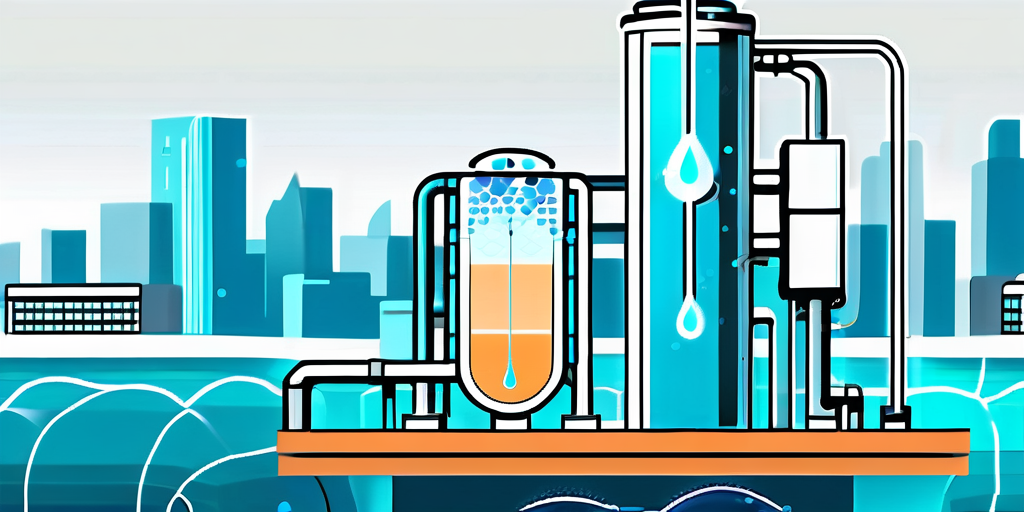

Innovation plays a crucial role in addressing the global water crisis. From advanced filtration systems to smart water meters, technology is driving significant advancements in the water sector. These innovations not only improve water quality and efficiency but also present lucrative investment opportunities.

Investing in water technology allows us to support the development and implementation of cutting-edge solutions. Whether it’s investing in companies that specialize in desalination technology or those focused on wastewater treatment, the potential for both financial returns and positive environmental impact is immense.

One of the most exciting developments in water technology is the use of artificial intelligence (AI) and machine learning algorithms to optimize water treatment processes. These technologies can analyze vast amounts of data in real-time, allowing for more efficient water purification and distribution. By leveraging AI, water treatment plants can predict equipment failures, optimize chemical dosages, and detect contaminants in water sources with unprecedented accuracy.

Furthermore, the integration of Internet of Things (IoT) devices in water systems is revolutionizing how we monitor and manage water resources. IoT sensors can provide real-time data on water quality, flow rates, and infrastructure performance, enabling proactive maintenance and rapid response to potential issues. This level of connectivity not only enhances operational efficiency but also promotes sustainable water management practices for a more resilient future.

Impact Investing in Water Conservation

Impact investing is gaining traction as investors recognize the power of their financial decisions to create positive social and environmental change. When it comes to water, impact investing can make a significant difference in conservation efforts.

Investing in water conservation projects, such as watershed restoration or rainwater harvesting initiatives, can yield both financial returns and measurable environmental outcomes. These investments not only contribute to water conservation but also create sustainable economic opportunities for local communities.

Watershed restoration projects involve the rehabilitation and protection of areas surrounding water sources, such as rivers, lakes, and streams. By implementing sustainable land management practices and restoring natural habitats, these projects help improve water quality, reduce erosion, and enhance biodiversity. Impact investors play a crucial role in funding these initiatives, which have far-reaching benefits for both the environment and the communities that depend on these water sources.

Rainwater harvesting is another impactful method of water conservation that is gaining popularity worldwide. This technique involves collecting and storing rainwater for various uses, such as irrigation, household chores, and even drinking water in some cases. Impact investors can support rainwater harvesting projects in water-stressed regions, helping to alleviate water scarcity issues and promote sustainable water management practices. By investing in rainwater harvesting infrastructure, investors not only contribute to water conservation efforts but also empower communities to become more resilient to the impacts of climate change.

Risks and Rewards of Investing in Water

As with any investment, there are risks associated with investing in water. Understanding these risks is crucial for making informed decisions and mitigating potential losses.

Market volatility, regulatory challenges, and the uncertain impact of climate change are just a few of the risks that investors need to consider. However, with proper research, diversification, and a long-term perspective, the rewards of investing in water can outweigh the risks. By investing in water, we can contribute to building a more resilient and sustainable future.

One significant risk to consider when investing in water is the potential for water scarcity. As the global population continues to grow, the demand for clean water is increasing, leading to concerns about water scarcity in many regions around the world. Investors need to assess how water scarcity may impact the companies they are investing in, as shortages can lead to operational disruptions and increased costs.

Another important factor to keep in mind is the regulatory landscape surrounding water resources. Government regulations can have a significant impact on the water industry, affecting everything from pricing structures to infrastructure development. Investors must stay informed about changing regulations and anticipate how these changes may influence their investments in the water sector.

Exploring Opportunities in Water Infrastructure

Water infrastructure is the backbone of our water systems. From dams and reservoirs to pipelines and treatment plants, investing in water infrastructure paves the way for sustainable water management.

Investing in water infrastructure projects can generate stable cash flows and provide essential services to communities. These investments have the potential to deliver long-term, inflation-protected returns, making them an attractive option for investors seeking both financial stability and sustainable impact.

One key aspect of water infrastructure investment is the incorporation of innovative technologies to enhance efficiency and sustainability. Advanced monitoring systems can help detect leaks in pipelines, reducing water loss and improving overall system performance. Additionally, the integration of renewable energy sources such as solar panels or hydropower can help make water treatment plants more energy-efficient and environmentally friendly.

Furthermore, investing in water infrastructure not only benefits the environment and public health but also contributes to economic growth. Improved water systems can attract new businesses to an area, creating job opportunities and stimulating local development. By ensuring reliable access to clean water, communities can thrive and prosper, fostering a more resilient and sustainable future for generations to come.

Case Studies of Successful Water Investments

Looking at real-world examples of successful water investments can provide valuable insights and inspiration for potential investors.

One such case study is the investment in a water technology startup that developed an innovative water purification system. This investment not only generated significant financial returns but also helped provide clean drinking water to communities in need. It serves as a testament to the power of investing in water to drive positive change.

Another compelling case study involves a large-scale infrastructure project that aimed to improve water access in a drought-affected region. By investing in the construction of reservoirs and irrigation systems, the project not only bolstered the local economy but also ensured a sustainable water supply for agricultural activities. This initiative highlights the multifaceted benefits of strategic water investments in addressing environmental and socio-economic challenges.

Furthermore, a noteworthy success story in the realm of water investments is the collaboration between a beverage company and a non-profit organization to fund watershed conservation projects. Through this partnership, critical ecosystems were protected, ensuring a stable supply of clean water for both the company’s production processes and local communities. This innovative approach demonstrates how corporate social responsibility initiatives can align with business interests to create lasting impacts on water sustainability.

Ethical Considerations in Water Investment

Investing in water requires careful consideration of ethical factors. Water is a basic human right, and ensuring access to clean and affordable water for all should be a priority.

Investors should focus on supporting companies and projects that prioritize equitable access to water and contribute to sustainable development. By investing ethically in water, we can align our financial goals with our values and promote social and environmental justice.

One important aspect to consider when investing in water is the impact on local communities. It is crucial to assess how water projects will affect the people living in the area, particularly marginalized groups who may already face water scarcity or contamination issues. Ethical investors should engage with stakeholders to understand their needs and concerns, ensuring that investments benefit the community as a whole.

Furthermore, ethical water investment goes beyond just providing access to clean water. It also involves supporting initiatives that protect water sources, promote water conservation, and address water pollution. By investing in companies that implement sustainable water management practices, investors can contribute to the long-term health of ecosystems and communities that depend on water resources.

The Role of Government Policies in Water Investment

Government policies play a crucial role in shaping the investment landscape for water. From regulations and incentives to funding and support, government actions can create opportunities or barriers for investors.

Understanding and staying informed about government policies related to water investment is essential for successful investing. By engaging with policymakers and advocating for sustainable water management practices, investors can influence positive change and create a more favorable investment environment.

One key aspect of government policies in water investment is the allocation of resources for infrastructure development. Governments often play a significant role in funding and implementing projects related to water supply, treatment, and distribution. By monitoring government budget allocations and infrastructure plans, investors can identify potential opportunities for collaboration or investment in public-private partnerships.

Furthermore, government policies can also impact the pricing and valuation of water resources. Regulations related to water usage fees, pollution control, and resource management can influence the financial performance of water-related investments. Investors need to consider these policy dynamics when evaluating the risks and returns associated with their portfolios.

Strategies for Long-Term Sustainable Profits in Water Investment

Investing in water is not only about making short-term gains but also about building a sustainable portfolio that generates long-term profits.

Diversification, thorough research, staying informed about industry trends, and investing in innovative solutions are all key strategies for long-term success in water investment. By adopting a holistic and patient approach, investors can make a positive impact on the world while achieving financial prosperity.

One important aspect to consider in water investment is the regulatory environment. Regulations play a crucial role in shaping the water industry, affecting everything from pricing structures to technological advancements. Understanding and staying compliant with these regulations is essential for investors looking to navigate the complexities of the water market successfully.

Furthermore, the global water crisis presents both challenges and opportunities for investors. As water scarcity becomes an increasingly pressing issue worldwide, there is a growing demand for sustainable water management solutions. Investing in companies that focus on water conservation, purification technologies, and infrastructure development can not only yield financial returns but also contribute to addressing this critical global issue.

Conclusion

Investing in water presents both financial and ethical opportunities. As the demand for water continues to rise, sustainable water investments can deliver long-term profits while addressing the critical challenges of the global water crisis.

By understanding the importance of water investments and exploring the various opportunities available, investors can make informed decisions that align with their financial goals and values. Together, we can contribute to building a more sustainable future—one drop of water at a time.